By Michael Gold

“Risk comes from not knowing what you are doing” –Warren Buffett

I am always asked where I think the market is going.

My answer is always the same: In the short run, I don’t know. But I am very confident about the long run.

At Gold Family Wealth we do not have an opinion about where the stock markets, interest rates, or the economy will be in a year from now. To quote Warren Buffett, the only thing forecasting the market or the economy does is simply make fortune tellers look good. Warren further states, “We believe that short-term market forecasts are poison and should be kept locked up in a safe place, away from children and also from grown-ups who behave in the market like children.” I just love that quote!

What does it mean to behave in the market like children?

I think about my own three little kids, Sebastian, 8; Aria, 6; and Pierce, 4. They tend to get overzealous about certain things like a new toy or going to the park or licking a lollipop; they eat too much candy and run around, bouncing off the walls, making funny faces. One time when our family was out to dinner, my little guy Pierce got onto the table and started dancing and making silly sounds. I thought to myself, if I did this I would probably be arrested – oh the joys of being a child.

As adults, we don’t dance on tables and make silly noises, but we can very easily be taken in by certain fads, such as tech stocks in the 90s or real estate in the early 2000s or the tulip bulb craze in the 1600-1700s or cryptocurrency in the past few years. The idea of putting your hard-earned money into a tech stock that has zero earnings, too much debt, and no future outlook is behaving like a child in the market.

When the markets turn down and the news gets ugly, the same investors who were allocating their hard-earned money to the aforementioned fads have an unbelievable record of mistiming the market.

For example, at the bottom of the 2001 bear market, investors moved a then-record amount of their money from stocks to cash. They then re-entered the market after it recovered.

At the bottom of the market in 2002, the S&P 500 stood at 776.76 down 49% – ouch! However, over the next five years the S&P 500 went up over 101.5%, to 1,565 by October 9, 2007.

Fast forward to the bottom of the 2008/2009 crisis, investors broke the record for stock market withdrawals, moving their money to cash in record numbers.

Imagine pulling all your money out at the bottom of 2002, losing almost half of your investable assets and saying, “I’m going to get out now, cut my losses and wait for the market to recover.” Then, when the market recovers, you feel comfortable reentering the market in the fall of 2009, and guess what? The financial crisis starts, and the S&P 500 drops 56%, bottoming in March of 2009. Then the market, per usual, rebounds, proceeding to run up over 400 % until the Covid crisis in 2020.

Investors who mistimed the market in this way, to quote Buffet, behaved a bit like children.

I was speaking with a good friend and client of my firm recently who was sharing his concern about current events and what he was hearing from so-called investment experts from big firms. They were forecasting a catastrophic market and ticked off apocalyptic-type recession talking points.

Here is the deal: In my experience, the more certain a forecaster is in their short-term prediction, the less likely they are to be accurate; it’s more likely they are looking for fanfare and media coverage.

But don’t take my word for it, as a cynical former New Yorker. Let’s look at empirical data. AII 82% bearish on March 5, 2009… 1 year later S&P 500 up 66.8%

In the summer of 2022, we’re seeing inflation at levels we have not seen in decades and a correction that has unfolded through the first five months of 2022, which is giving many investors pause. What is going on, and what should you do?

As you consider your and your family’s financial wellbeing, you are far better off ignoring all the loud forecasters and instead focusing on your plan and what you can control.

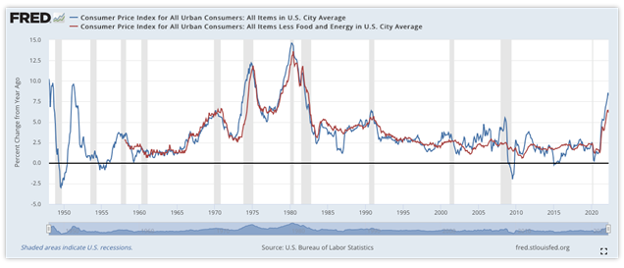

As you see from the chart above, in the 1970s into the very early 80s, inflation was off the charts. A demographic shift in the U.S. and geopolitical tensions creating supply issues – especially around oil and gas – spurred the issue.

Sound familiar?

Back in the 70s, the baby-boom generation was made up of young adults who were starting families, working, and buying cars, gas, food, clothing, housing, etc. 70 million people all buying stuff at the same time. Supply, demand 101.

Today, all those baby boomers are still spending, and they have a lot – and I mean a lot – of money to spend. About 65 million people make up my generation, Generation X, and we are in our peak earning years. And the Millennial generation, with 72 million people, is even larger than the baby boomers; millennials are starting families and beginning to earn good incomes. That’s a huge number of people buying stuff at the same time. What do you think that will do to prices?

To compound that, there has been cheap money pushed into our economy over the past 14 years, uber-low interest rates, a supply chain crunch and a war between Russia and Ukraine. Ukraine is the breadbasket of the world, impacting food prices, and Russia controls about 38% of oil in Europe.

The combination of these factors is rather textbook, and the market action should not be a surprise.

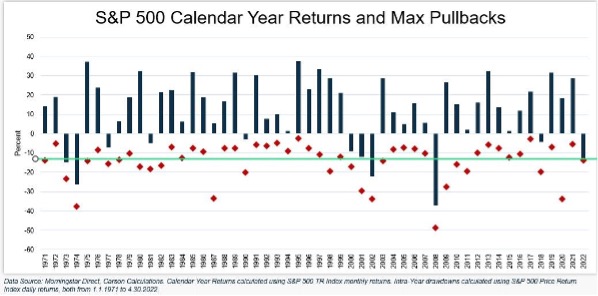

A correction is a market drop of 10% or more; if the market drops more than 20%, they simply change the language from correction to bear market.

Market corrections happen all the time – a correction has taken place every year for the past 50 years. Forecasting one is like saying it will snow in Alaska.

The question then becomes, “Why not get out of the market now that it dropped into correction territory, before it turns into a bear market?”

The No. 1 reason is most corrections never officially turn into bear markets, in fact less than 1 in 5 corrections turn into bear markets. With odds like this, it is rather illogical to move to cash in the hopes of avoiding a bear market. You would basically be going to cash right before the historical bottom.

You now know that corrections happen all the time, sometimes resulting from events like we are experiencing now and other times for no particular reason.

You also now know that the majority of corrections never evolve into bear markets.

And you know that every single correction and ever single bear market in history has given way to a full recovery, every time.

Knowing all this, it seems ridiculous to ever panic and go to cash, given the empirical data, the math, the historical evidence and the nature of the market.

If we ignore these facts and “behave like children,” moving to cash can do serious damage to your portfolio. If we keep a level head and make smart decisions around our money, we can capitalize on this crisis and every apocalypse du jour.

If you have questions about your investing strategy or your financial plan, a member of our team would love to help you. Let’s talk!

This content is for general information only and is not intended to provide specific advice, and endorsement or recommendations for any individual. Past performance is no guarantee of future results. All indices are unmanaged and may not be invested into directly. Investing involves risk, including possible loss of principal. No strategy assures success or protects against loss. To determine what is appropriate for you, consult a qualified professional.