The U.S. jobs market roared back to life in March. The economy added or reclaimed 916,000 jobs, shattering expectations of a 150,000 increase. Workers being recalled or hired to fill openings at restaurants and bars contributed 176,000 jobs to March’s gains. Previous months were revised higher by 156,000.

Key Points for the Week

- The U.S. economy seems to be in rebound mode. Non-farm payrolls added 916,000 jobs, beating expectations of only 150,000.

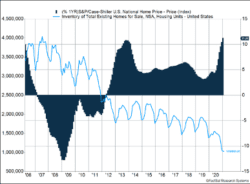

- A weak supply of existing homes contributed to housing prices rising more than 11% over the last year, according to S&P data.

- The S&P 500 rose 4.4% last month and 6.2% in the first quarter as the strong equity recovery that began a year ago continued.

Wages dropped slightly as the large employment gains primarily consisted of lower-paying jobs, pushing employment up but wages down. Some workers returned to the labor force, but even more already in the labor force were hired, so unemployment dipped to 6.0%.

In other economic news, housing prices increased 11.2% in major metropolitan areas over the last year as a shortage of homes for sale spurred a price boom. U.S. manufacturers continue to recover. The US ISM Manufacturing Purchasing Managers Index rose to 64.7, the highest level since 1983.

The U.S. stock market rose on the news. The S&P 500 gained 1.2%, closing up 4.4% for the month and 6.6% for the first quarter. The MSCI ACWI index added 1.1% last week. The broad index of global stocks rose 2.7% for the month and 4.6% for the quarter. The Bloomberg BarCap Aggregate Bond Index edged up 0.2% last week but dipped 1.2% for the month and sagged 3.4% for the quarter as the strengthening economy pushed rates higher.

Figure 1

Happy at Home

During COVID lockdowns almost all of us have spent more time at home than normal. Staring at the same four walls prompted many of us to notice they needed to be painted or some other remodeling project needed to be done. The retail sales category that includes home improvement stores has risen 14.2% since last year. Other people reprioritized and are content where they are. Whatever the reason, people aren’t putting homes on the market and home prices have increased rapidly in recent months.

Last week the S&P CoreLogic Case-Shiller Home Price Index showed that home prices in major metropolitan areas have increased by 11.2% over the last 12 months (Figure 1), the highest increase since February 2006. The surge in prices was seen across the country, with some metro areas, such as Phoenix and Seattle, seeing price hikes of 15.8% and 14.3% respectively. The rate of increases over the past six months is even faster than during the subprime lending boom that led to the global financial crisis. This surge can be attributed to simple economics — demand has surged while supply has tumbled.

Several factors have led to the increase in demand for homes. First, mortgage rates have fallen dramatically since the beginning of the pandemic, with the national average for a 30-year mortgage dropping below 3% for the first time ever. Also, more millennials are reaching their 30s, which is considered prime homebuying years. At the same time, members of Gen Z are reaching their early 20s and beginning to enter the buyers’ market.

While more and more buyers have entered the market, the inventory of available homes has decreased to record lows. National inventory dropped to a little more than 1 million units in January 2021, the lowest level since 1982. Fewer people are willing to sell their houses because of the uncertainty caused by the pandemic, and more potential sellers are deciding to take advantage of the low rates to refinance their homes and stay where they are. New homes are also becoming more expensive due to rising material costs and slowed supply chains.

Not only has the decrease in available houses for sale led to higher prices, but it has also caused potential homebuyers to deploy some unusual tactics as they try to jump on new listings. The number of buyers who admitted to making “sight unseen” offers, those made without seeing the property in person, has more than tripled from 20% in 2018 to 63% in 2020. Also, the percentage of homebuyers who requested remote video tours increased from 1% to 10%. Both trends can be attributed to the emphasis on social distancing since last March and are also signs of the lengths to which buyers will go when inventories are so low.

One factor that may cool off the housing market is potential mortgage rate hikes. The 30-year fixed-rate mortgage average has already increased from a low of 2.65% on January 7, 2021, to 3.18% on April 1. While the increase will have a more immediate effect on refinances, which are more sensitive to rate increases, over time the increase in rates can affect affordability, especially at these elevated price levels.

The improving jobs numbers from March will contribute to additional demand. As people return to work and more normal activity resumes, demand for homes could increase even more. But the problem is supply. If more homes don’t become available for sale, higher prices may slow the recovery as buyers are priced out of the market.

—

This newsletter was written and produced by CWM, LLC. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The views stated in this letter are not necessarily the opinion of any other named entity and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

S&P 500 INDEX

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

MSCI ACWI INDEX

The MSCI ACWI captures large- and mid-cap representation across 23 developed markets (DM) and 23 emerging markets (EM) countries*. With 2,480 constituents, the index covers approximately 85% of the global investable equity opportunity set.

Bloomberg U.S. Aggregate Bond Index

The Bloomberg U.S. Aggregate Bond Index is an index of the U.S. investment-grade fixed-rate bond market, including both government and corporate bonds.

https://www.census.gov/retail/marts/www/marts_current.pdf

https://www.census.gov/construction/nrc/pdf/newresconst.pdf

Compliance Case # 00998776