Retail sales and food services jumped 17.7% in May, beating estimates of 8% growth. The strong rebound follows sharp declines the previous month created by social distancing. Even with the increase, sales are still 6.1% below where they were one year ago. China’s retail sales fell 2.8%. The world’s largest consumer market hasn’t embraced openness as quickly as the U.S. and some Chinese cities have recently seen a spike in new cases.

Key Points for the Week

- Retail sales jumped 17.7% in May, a sharp bounce back as more states loosened social distancing restrictions.

- New virus cases jumped in many key states, and studies showed a steroid helped reduce the risk of death in some COVID-19 patients.

- The S&P 500 gained 1.9% in a rebound from last week’s declines.

Retail sales benefited from the widespread easing of lockdown restrictions across the U.S. Unfortunately, several states have seen an increase in new coronavirus cases, and the U.S. recently logged the two highest tallies of new infections since May 1. However, deaths continue to trend lower, and a study out of England showed a common steroid reduced the risk of death by 33% in the sickest patients.

The good outweighed the bad last week, based on the market, and the S&P 500 gained 1.9%. The MSCI ACWI edged up 2.0%. The Bloomberg BarCap Aggregate Bond Index rose 0.2%.

Data releases will be thin this week. New case data from states such as California, Texas, and Florida will be watched closely to see how quickly people adjust behaviors to slow the spread of the coronavirus once a surge of cases reappears. First-time unemployment claims and durable goods orders may provide additional evidence for a labor recovery and show how manufacturing is being affected by reopening.

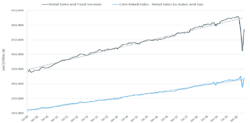

Figure 1 – Source: Factset

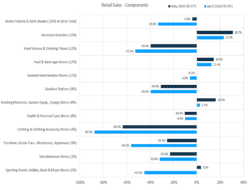

Figure 2 – Source: Factset

Let’s Go Shopping!

The American consumer returned to form in May. Retail sales, including food services, rebounded 17.7% over April. The double-digit increase shattered expectations of an 8% recovery and followed three straight months of declines. As the economy reopens and consumers become more willing to venture out, retailers are one of the groups benefiting.

The rebound is also likely being fueled by people being rehired and the steady flow of government aid, including direct payments to individuals. Regardless of the source, the greater-than-expected gains offer hope for a more rapid recovery, As Figure 1 shows, we still have a way to go. Even with the sharp increase, sales were 6.1% below where they were one year ago.

Figure 1 also provides a better understanding of what parts of the economy are bouncing back most rapidly. Core retail sales, which exclude food service, autos, and gasoline, didn’t rise nearly as much. As can be seen in Figure 2, sales at gasoline stations, motor vehicle retailers, and restaurants all snapped back but remain well below year-ago levels.

People seem to be spending time shopping on the computer or fixing something around the house. Home repair and gardening stores continued to report strong sales gains as did grocery stores. Non-store retailers (internet retailers primarily) continued to experience a surge of orders. Sales were up 30.7% over the last year. Other goods, such as clothing and furniture, showed improvements in their comparison to previous years but still lagged well behind the previous year’s volume.

This sharp rebound meets our expectations for a strong rally in consumer spending. Demand has been pent up as many consumers delayed purchases during the lockdown. Whether it continues will likely be based on how well the spread of the virus is contained.

Last week contained mixed news regarding the coronavirus’s spread. The bad news is the number of cases spiked as Americans took some steps back from social distancing. Whether at a protest, in the neighborhood or at lacrosse practice, people didn’t stay as far away from each other as they did a few short weeks ago. Retailers are reacting already. If more companies close stores in areas with a virus resurgence, then it will be hard for the recovery to continue. On the other hand, news of a steroid reducing the risk of death for patients with a severe case of COVID-19 marks another incremental step toward better care and higher survivor rates. Even though cases have spiked, the number of deaths continues to trend lower.

As mentioned in the previous section, we’ll be watching and hoping for the number of new cases to trend lower in states such as California and Florida. Reopening in the midst of a pandemic requires great wisdom as governments and companies return to work as much as possible while retaining the measures most likely to slow the spread of the virus. Whether from a personal or portfolio perspective, risks still exist, and lowering them quickly well help speed the recovery.

—

This newsletter was written and produced by CWM, LLC. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The views stated in this letter are not necessarily the opinion of any other named entity and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

S&P 500 INDEX

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

MSCI ACWI INDEX

The MSCI ACWI captures large- and mid-cap representation across 23 developed markets (DM) and 23 emerging markets (EM) countries*. With 2,480 constituents, the index covers approximately 85% of the global investable equity opportunity set.

Bloomberg U.S. Aggregate Bond Index

The Bloomberg U.S. Aggregate Bond Index is an index of the U.S. investment-grade fixed-rate bond market, including both government and corporate bonds

https://www.worldometers.info/coronavirus/country/us/

https://www.cnbc.com/2020/06/16/us-retail-sales-may-2020.html

Compliance Case: 00761197