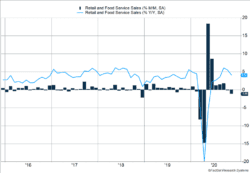

The economic slowdown continues. Initial jobless claims climbed 885,000 last week. In the face of additional restrictions and heightened health risks, consumers have scaled back activity. Retail and food service sales dipped 1.1% last month (Figure 1).

Key Points for the Week

- A new support package for the unemployed, airlines, and small businesses that includes direct payments to most individuals is expected to be signed into law this week.

- Retail sales shrank last month, and weekly initial unemployment claims increased as the economic pause continues amid a COVID-19 surge.

- U.S. pressure on Chinese companies is increasing with investment bans and tighter regulations on companies trading on U.S. exchanges.

In response to the weakness, a new support package is moving quickly through Congress. It will provide direct payments to many Americans and additional unemployment assistance. The bill includes support for small businesses, airlines, schools, and public transportation. Economic growth should also get a boost from the Food and Drug Administration’s approval of a second COVID-19 vaccine.

Stocks moved higher last week. The S&P 500 added 1.3% and erased the previous week’s losses. The MSCI ACWI index rose 1.6%. The Bloomberg BarCap US Aggregate Bond Index dropped 0.1%.

The Federal Reserve met last week and left rates unchanged. It plans to continue buying government and mortgage bonds to keep long-term interest rates low. The Fed did grow more optimistic about the economy. Officials expect a shallower decline of 2.2% to 2.5% this year and a rebound between 3.7% and 5.0% next year. Rates are expected to remain low through at least 2023.

Figure 1

Increasing the Pressure

The increasingly confrontational relationship between the U.S. and China continues to move in the direction of more hostility. In response to a presidential executive order issued November 12, major indexes announced some Chinese companies will be removed from global benchmarks. Last week, President Trump signed a bill requiring Chinese companies listed on U.S. exchanges to be audited by U.S. auditors or face delisting.

The change in administrations seems unlikely to provide much relief. Large majorities in both parties have a negative view of China. The bill to require U.S. auditors of Chinese firms was passed on a voice vote in the House of Representatives and by unanimous consent in the Senate, indicating broad, bipartisan support.

The negative view stems from several key divergences in the U.S.-China relationship:

- China has adopted a more aggressive foreign policy. The country’s national director of intelligence recently wrote, “Beijing intends to dominate the U.S. and the rest of the planet economically, militarily and technologically.”

- Chinese companies are accused of engaging in economic espionage, in which they use intellectual property from U.S. firms to capture market share.

- China is running a massive trade surplus with the U.S., which has grown as a side effect of COVID-19. The emphasis on goods over services has benefited Chinese manufacturers. Last month, the trade deficit with China increased 9%.

- China promised to purchase more U.S. goods as part of a trade deal last year. According to Chad Bown at the Peterson Institute on Economics, it has only purchased 60% of the goal.

- Persecution of the Uighur minority continues to draw criticism.

The failure to purchase goods is at least partly COVID-related. Other factors have also pushed the trade deficit higher. The lack of travel and strong lockdowns slowed Chinese purchases of goods and services. U.S. consumers were willing to spend their stimulus checks, and China benefited from its role as a key manufacturing hub for consumer and technology goods.

As we look forward to a post-COVID world, U.S.-Chinese relations will be an area we watch closely for potential risks. Last year, when a trade truce was reached, the relationship seemed to be getting better. COVID has undercut that momentum, and the U.S. political environment indicates the U.S.-China relationship will be a top risk for years to come.

—

This newsletter was written and produced by CWM, LLC. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The views stated in this letter are not necessarily the opinion of any other named entity and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

S&P 500 INDEX

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

MSCI ACWI INDEX

The MSCI ACWI captures large- and mid-cap representation across 23 developed markets (DM) and 23 emerging markets (EM) countries*. With 2,480 constituents, the index covers approximately 85% of the global investable equity opportunity set.

Bloomberg U.S. Aggregate Bond Index

The Bloomberg U.S. Aggregate Bond Index is an index of the U.S. investment-grade fixed-rate bond market, including both government and corporate bonds

The Russell 1000® Growth Index measures the performance of the largecap growth segment of the US equity universe. It includes those Russell 1000® companies with higher price-to-book ratios and higher forecasted growth values.

The Russell 1000® Value Index measures the performance of the largecap value segment of the US equity universe. It includes those Russell 1000® companies with lower price-to-book ratios and lower expected growth values.

https://www.congress.gov/bill/116th-congress/senate-bill/945/actions

https://www.wsj.com/articles/china-is-national-security-threat-no-1-11607019599

https://abcnews.go.com/Business/wireStory/us-trade-deficit-rises-17-631-billion-october-74537787

https://en.wikipedia.org/wiki/Holding_Foreign_Companies_Accountable_Act

https://www.census.gov/retail/marts/www/marts_current.pdf

Federal Reserve: Industrial Production and Capacity Utilization Data

https://www.cnn.com/2020/12/20/politics/stimulus-latest-shutdown-deadline/index.html

Compliance Case: 00905956