The U.S. economy returned to rapid job growth last month as fewer new COVID cases and loosening restrictions increased demand for labor. Restaurants and bars accounted for more than half the net gains, as employment in this hard-hit sector increased 286,000. Despite efforts to reopen schools, government employment dropped last month.

Key Points for the Week

- The U.S. economy created 379,000 jobs last month as the vaccine rollout and decisions to ease restrictions improved demand for labor.

- U.S. manufacturing increased for the ninth straight month and reached a post-COVID high.

- The U.S. Senate passed a $1.9 trillion stimulus package that includes more direct payments, extended enhanced unemployment benefits and aid to local governments and schools.

U.S. manufacturing is contributing to the demand for labor. The ISM Manufacturing Index rose for the ninth straight month and reached a post-COVID high. The U.S. Senate passed $1.9 trillion in new stimulus designed to boost demand while vaccines are making it more possible to spend money. House approval and a presidential signature are expected this week.

The strong employment data supported U.S. stocks and pressured bonds, which often do worse when the economy improves more than expected. Last week, the S&P 500 climbed 0.8%. The MSCI ACWI index edged up 0.1%. The Bloomberg BarCap Aggregate Bond Index fell another 0.8% last week and is down 2.9% this year.

The additional stimulus hitting the economy as it begins to reopen is raising concerns about inflation for some. Consumer Price Index reports from the U.S. and China this week will offer some insight into inflation trends. Because China’s economy has rallied more quickly from COVID, inflation there may be a warning sign for the U.S.

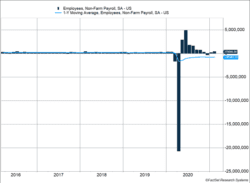

Figure 1

Job Growth Returns

A year into the world upended by COVID-19, some of the workforce is moving back to the office, while many continue to work remotely. Others are just getting back to work while millions more remain without employment.

The number of people getting back to work in February was larger than expected. A robust 379,000 jobs were added last month, more than double the expected 181,500. It was the second straight increase. Just two months ago, there was a surprise to the downside with December payrolls falling significantly under the pressure of record new COVID cases. As the economy continues to open in the coming months, there’s good reason to believe this trajectory will continue.

The headline unemployment rate for last month registered at 6.2%, down 0.1% from January. The drop also beat expectations as a slight increase was expected. Unemployment fell in January, but it was a result of the labor force shrinking. In February, the civilian labor force grew by 40,000, but job creation drew in new and returning workers and many others.

Restaurant and bar employment rose 286,000. As more people receive the vaccine and more states loosen dining restrictions, we expect dining demand to continue to climb. Small gatherings with some degree of social distancing seem likely to increase as more people get their second shot.

Increasing the number of people in the workforce is crucial to getting the economy back to pre-pandemic highs. The participation rate was flat in February at 61.4%, which is well below pre-crisis levels. A broader measure of unemployment, which factors in those with part-time jobs for economic reasons and discouraged workers, was 11.1%. Getting labor force participation back above 63% will require many people returning to jobs.

The positive news from last month is a good start, but the economy has a long way to go. Job losses started mid-March last year, and while they’ve abated, they remain above pre-crisis levels. At the current pace, it will be four years before the economy catches up to its previous highs. Payrolls are 9.5 million below February 2020, so the gap is large. The leisure and hospitality sector accounts for 3.5 million of the total number. This sector could see a strong rebound as more vaccines are distributed and the economy gains momentum. February was a good start, but we have a long way to go.

—

This newsletter was written and produced by CWM, LLC. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The views stated in this letter are not necessarily the opinion of any other named entity and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

S&P 500 INDEX

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

MSCI ACWI INDEX

The MSCI ACWI captures large- and mid-cap representation across 23 developed markets (DM) and 23 emerging markets (EM) countries*. With 2,480 constituents, the index covers approximately 85% of the global investable equity opportunity set.

Bloomberg U.S. Aggregate Bond Index

The Bloomberg U.S. Aggregate Bond Index is an index of the U.S. investment-grade fixed-rate bond market, including both government and corporate bonds

https://www.bea.gov/news/2021/personal-income-and-outlays-january-2021#:~:text=Disposable%20personal%20income%20e%20is,reside%20in%20the%20United%20States

https://markets.businessinsider.com/news/stocks/economic-outlook-us-gdp-2021-forecast-coronavirus-stimulus-goldman-sachs-2021-2-1030059281#:~:text=Goldman%20Sachs%20upgraded%20its%20outlook,%25%20from%204.3%25%20in%202022

https://www.morganstanley.com/ideas/global-economic-outlook-2021#:~:text=Morgan%20Stanley%20projects%20strong%20global,envision%20a%20return%20to%20normal

https://www.businessinsider.com/us-economy-outlook-bofa-boost-gdp-growth-forecast-2021-stimulus-2021-2#:~:text=The%20US%20economy%20is%20set,after%20the%20COVID%2D19%20pandemic

https://am.jpmorgan.com/hk/en/asset-management/adv/insights/portfolio-insights/weekly-strategy-report/

https://fred.stlouisfed.org/series/T5YIE

https://www.cnbc.com/2021/02/25/stocks-just-got-some-new-competition-from-bonds-as-10-year-rate-tops-dividend-yield.html

https://www.cnbc.com/2020/12/16/fed-raises-its-economic-outlook-slightly-sees-4point2percent-growth-next-year-and-5percent-unemployment-rate.html#:~:text=predicted%20in%20September.-,The%20Fed%20also%20upped%20its%202021%20real%20GDP%20forecast,%25%20from%204.0%25%20expected%20previously.&text=Next%20year%2C%20core%20PCE%20inflation,from%20September’s%20forecast%20of%201.7%25

Compliance Case #00973614